Digital Investment Market Will Gain More Traction Registering A CAGR of 16.1% By 2028 Due To Its Quick Accessibility, Cheaper Cost Structure And User-Friendly Nature | Million Insights

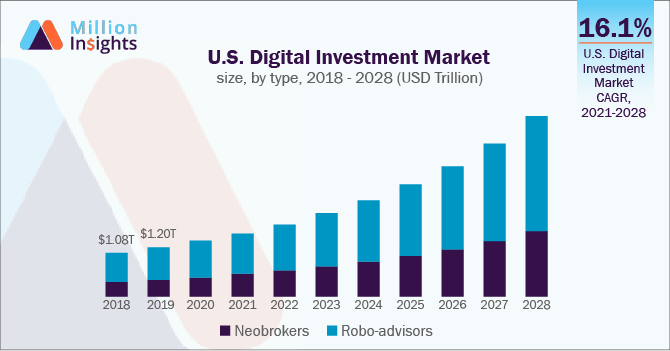

The global digital investment market size is estimated to reach USD 6,964.18 billion by 2028 and is expected to register a CAGR of 16.1% from 2021 to 2028, according to a new report by Million Insights. The cheaper cost structure of digital investments is the crucial factor that drives the growth of the market. Quick accessibility and user-friendly structure of the digital investment is another factor that drives the industry growth. Data security and compliance concerns are the key factors restraining the growth. Most of the major companies working in the market are adopting the strategy of product innovations to capture maximum market share.

The COVID-19 pandemic has positively impacted market growth. The digital investment market observed significant growth due to the increased adoption of digital investment platforms for efficient wealth and asset management in a volatile market during the COVID-19 pandemic. Most of the investors took benefit of investment opportunities that occurred during the COVID-19 pandemic. Thus, the market for digital investments is expected to witness steady growth over the forecast period.

Request Absolutely Free Demo of Digital Investment Market Report @ https://www.millioninsights.com/snapshots/digital-investment-market-report/request-demo

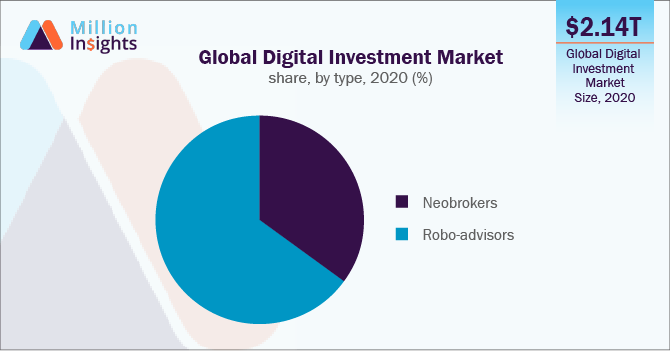

The robo-advisors segment dominated the market and contributed a revenue share of around 65% in 2020 and is forecast to expand at a CAGR of 15.8% from 2021 to 2028. Robo-advisors have minimum overhead costs as they are hosted electronically and permit customers to change and personalize their online investments to achieve long-term financial goals and short-term investment plans. Moreover, the customers are looking out for digital solutions that help them to budget, save, and invest their money.

North America accounted for the largest market share of more than 65% in 2020. The U.S. contributed a major share to the large revenue generation of the market. The maximum usage of digital investment platforms such as robo-advisors and neobrokers due to their important benefits such as accessibility, security, ease, and personalization contributed to more revenue generation in North America.

To browse report summary & detailed TOC, please click the link below:

https://www.millioninsights.com/snapshots/digital-investment-market-report

Digital Investment Market Report Highlights

• Asia Pacific is expected to register the highest CAGR of 16.8% from 2021 to 2028. Digitalization and the COVID-19 pandemic have rapidly increased consumer demand for digital investment in this region

• The neobrokers segment is likely to register the highest CAGR of 16.5% from 2021 to 2028. Neobrokers provide access to all types of investment. They offer simplicity, as the digitized process makes it easy for users to trade and invest

• The robo-advisors segment held the largest revenue share of more than 65% in 2020 and is anticipated to expand at a CAGR of over 15.0% from 2021 to 2028, due to the benefits of robo-advisors like minimum overhead costs

Digital Investment Market Segmentation

Million Insights has segmented the global digital investment market based on type and region:

- Digital Investment Type Outlook (Revenue, USD Billion, 2017 – 2028)

- Neobrokers

- Robo-advisors

- Digital Investment Regional Outlook (Revenue, USD Billion, 2017 – 2028)

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- Central & South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa

- North America

List of Key Players of the Digital Investment Market

- Robinhood Markets, Inc.

- eToro Ltd.

- Betterment LLC

- The Vanguard Group, Inc.

- Plus500

- Ally Financial Inc.

- TD Ameritrade, Inc.

- Charles Schwab & Co., Inc.

- Stash Financial, LLC

- E-Trade Financial Holdings, LLC

Take a Glance at The Press Release Snapshots Available With Million Insights:

• Flights Market: The global flights market size is expected to reach USD 208.1 billion by 2028, at a CAGR of 4.5% from 2021 to 2028.

• Desktop PCs Market: The global desktop PCs market size is expected to reach USD 27.6 billion by 2028, registering at a CAGR of -0.2% over the forecast period.

About Million Insights

Million Insights, is a market research and consulting company, provides syndicated as well as customized research reports and consulting services. We have a comprehensive marketplace, that will enable you to compare data points, before you make a purchase. Enabling informed buying, is our motto and we strive hard to ensure that our clients get to browse through multiple samples, prior to an investment. Service flexibility & the fastest response time are two pillars, on which our business model is founded. Our market research report store includes in-depth reports, from across various industry verticals, such as healthcare, technology, chemicals, food & beverages, consumer goods, material science & automotive.

Media Contact

Company Name: Million Insights

Contact Person: Ryan Manuel

Email: Send Email

Phone: 91-20-65300184

Address:Office No. 302, 3rd Floor, Manikchand Galleria, Model Colony, Shivaji Nagar

City: Pune

State: Maharashtra

Country: India

Website: https://www.millioninsights.com/snapshots/digital-investment-market-report